Contents

tifia mt4s charge a service fee for matching buyers and sellers who trade on their exchange and networks. Market markers set both the bid and the ask prices on their systems and display them publicly on their quote screens. The spread is typically kept lower than that investors can find in ECNs due to the fact that market makers generate their profit via the spread. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

Data Center Transmission Control Protocol utilizes ECN to enhance the Transmission Control Protocol congestion control algorithm. Whereas the standard TCP congestion control algorithm is only able to detect the presence of congestion, DCTCP, using ECN, is able to gauge the extent of congestion. However, UDP requires that congestion control be performed by the application, and early UDP based protocols such as DNS did not use ECN. More recent UDP based protocols such as QUIC are using ECN for congestion control.

If you’re ready to start exploring VPS trading with FXTM, contact your dedicated Account Service Manager who will be more than happy to help. In June 2015, Apple Inc. announced that OS X 10.11 would have fxtm review 2021 turned on by default, but the OS shipped without that default behavior. Many modern implementations of the TCP/IP protocol suite have some support for ECN; however, they usually ship with ECN disabled.

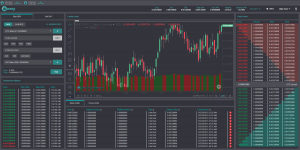

Matching systems receive orders and route the activity through a matching engine instance where the prices are checked against current resting limit orders. If no match is found, the order is placed in the book immediately as a quote. Call markets accept orders one at a time, with buying and selling prices determined based on the exchange activity after the order is placed. An ECN makes money by charging a fee for each transaction to meet financial obligations. It attempts to eliminate the third party’s role in executing orders entered by an exchange market maker or an over-the-counter market maker and permits such orders to be entirely or partly executed. Orders placed through ECNs are usually limit orders, which is particularly useful for safely trading after hours, given the volatile effect that can have on a stock’s price.

GO Markets, Exness, and XM are some of the most popular platforms. Without ECNs, it would take considerably longer for buyers and sellers to be matched with one another, making it more difficult to enter or exit positions and adding to the costs and risks of trading. One of the downsides of using ECNs is that they have access fees and commission charges that can jack up the overall price of use.

As expected, ECN reduces the number of packets dropped by a TCP connection, which, by avoiding a retransmission, reduces latency and especially jitter. A 2009 proposal suggests marking SYN-ACK packets as ECN-capable. This improvement, known as ECN+, has been shown to provide dramatic improvements to performance of short-lived TCP connections.

How Do You Use an ECN in Forex Trading?

We therefore focus on key policy dossiers at EU and transnational levels to align policies with science. In Nicollet County, dispatchers recently worked with a vulnerable adult with a medical condition that makes him unable to speak. Because texting is his main mode of communication, dispatchers trained him on the proper way to text 911. Since then, he has used this service a couple of times to get help. Our goal with these services is to deliver information to people in real-time to keep them safe. Learn more about ECN’s year in review and other Department of Public Safety work.

ECNs are computer-based programs that connect retail forex investors with major brokerages, all around the clock. After logging on to the ECN platform, investors will see the best available bid and ask quotes displayed from multiple market participants. Along with ECNs, matching systems and call markets are also considered forms of alternative trading systems.

And early reporting of such cases using the ECN feedback mechanism. Packet can be expected to drop these packets under congestion. In the event of negative client account balance, the company applies negative balance protection and converts a client’s losses to zero balance so that the client does not have debts to the company. Many Minnesotans are now wearing mini-computers on their wrists in the form of smartwatches. But new crash reporting features in those devices are causing unforeseen issues at 911 dispatch centers across the state.

Understanding ECN Brokers

Emergencies are never planned and that’s why Minnesota has services in place to help you in your time of need. Some of the most well-known are the 911 system and wireless emergency alerts, or WEAs. Now that we’ve entered a new year, we have an idea of just how many times those services were used in 2022. An iOS/Android-based mobile app with access to trading from anywhere in the world. VIP accounts for professionals with lower commission and best trading conditions the Company can offer. We provide access to two types of accounts with orders executed in the ECN system.

- Since the Transmission Control Protocol does not perform congestion control on control packets , control packets are usually not marked as ECN-capable.

- O Thirdly, the sender may make a leap of faith that ECN will work.

- Text-to-911 continues to serve as a valuable tool for various populations in Minnesota.

- The ECN provides an electronic system for buyers and sellers to come together for the purpose of executing trades.

An ECN broker is a financial intermediary that uses electronic communications networks to give clients direct access to other participants in equity and currency markets. Because an ECN broker consolidates price quotations from several market participants, it can generally offer its clients tighter bid/ask spreads than would be otherwise available to them. It also avoids the wider spreads that are common when using a traditional broker and provides overall lower commissions and fees. For those concerned about privacy, the ECN can provide a level of anonymity to those who desire it. This can be particularly attractive to investors interested in making larger transactions.

Some of the different ECNs include Instinet, SelectNet, and NYSE Arca. Instinet was the first ECN, founded in 1969, and is used by small brokerages and for transactions between institutions. Finally, the wider spreads may complicate the process of calculating break-even and stop-loss points for some investors. ECNs enables trading to happen outside of traditional trading hours, therefore enabling investors to react to or anticipate after-hours news. Within the ECN, groups of experts in specific sectors discuss competition problems and promote a common approach. In this way, the ECN allows competition authorities to pool their experience and identify best practices.

ECN Forex accounts for professionals

Per-trade-based commissions can be costly and can affect your bottom line and profitability. The Members of the ECN have also engaged in cooperation and exchange of best practices in the area of merger control by setting up anEU Merger Working Group. Needs to review the security of your connection before proceeding. Have an interest in protecting both service quality and the network. Packet, from this SSRC since the receiver joined the RTP session.

It is therefore important that you provide as much information as possible in your submission as over 100 applications are usually received for the 30 places. You can trade with the high speed of order execution through MetaTrader 4/5 and cTrader platforms. Extensive information about trading on ECN can be found in “Trading accounts” section. In addition to that, a detailed description of a special forex account type for premium clients is available on “Prime accounts” page. The introduction of ECN trading was a milestone for the modern forex industry. With direct access to liquidity providers, automatic order execution and matching, it has become the way forward for many forex traders around the world.

Operation of ECN with TCP

Through the ECN, the competition authorities inform each other of proposed decisions and take on board comments from the other competition authorities. In this way, the ECN allows the competition authorities to pool their experience and identify best practices. Session also will experience packet loss and increased delay. Reception quality of the original media stream at the translator.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Uncertainty if any duplicate or packet loss was an not-ECT or ECT. ECN-CE marked, including ECN-CE marks in any duplicate packets.

Data Center TCP

Flow to react to congestion signalled by barefoot investor review-marked packets. Trading activity with an ECN broker is completely anonymous. Prices reflect real, live market conditions at that time with the ECN providing a level of privacy to those who need it, such as those executing large orders. An ECN broker helps clients enter the currency markets directly by matching ECN trades between market participants and then passing the orders to the liquidity providers. An ECN is an automated system that publishes orders entered by market participants directly to third parties and individual traders. Those orders are then automatically executed by matching buy and sell orders at the best price available.

In the country of your residence you should register an account with RoboMarkets Ltd (read more).

Live prices are constantly moving and especially when trading sessions overlap, a true ECN broker may offer floating spreads. The broker will charge a fixed commission every time you trade, as this is their profit. That said, it is certainly more transparent than the costs involved when using a market marker. On the other side, traders get access to different quotes for execution and are shown the best bid and ask prices available in the market.

These brokers help clients directly access stock or currency markets on ECNs that they would not have access to otherwise. Without market makers and ECNs, it would take considerably longer for buyers and sellers to be matched with one another. This would reduce liquidity, making it more difficult to enter or exit positions and adding to the costs and risks of trading. Another disadvantage of using ECNs is that the platform is less user-friendly than those provided by traditional brokers.

The service was launched in 2017 as a primary 911 contact for people who are deaf, deafblind and hard of hearing. But we’ve learned that non-verbal individuals are also finding it useful. You may be surprised to know that 911 dispatch centers across the state received more than 2.6 million calls for help. If you think that’s a large number, it’s actually 300,000 less than the number of calls placed to 911 in 2021.